HousesMostWanted.com

FORECLOSURES

JOIN OUR NEWSLETTER

JOIN US ON LINKEDIN

Improving Our Neighborhoods...One House At A Time!

FORECLOSURE & SHORT SALES

We realize and fully understand that many homeowners today find themselves in difficult situations, with the decline in home values and the economic downturn. Your home may be worth far less than what you paid for it just a few years ago, or financial difficulties may have made it impossible to keep up with paying your mortgage.

If you’re facing the prospect of foreclosure, or owe more than your home is worth, selling your home through traditional methods may prove extremely difficult. Once the foreclosure process begins, you may not have time to wait for a realtor, find a buyer and wait for closing. Under those circumstances and may others, WE CAN HELP !

We work with homeowners facing foreclosure or any number of difficult situations to find an ideal solution for their property. We can make a fast, fair offer on any property, in any condition, in any location.

HOW IT WORKS

When we buy your property, we pledge:

•A fast, fair offer

•No fees or commissions

•Simple, no-hassle closing, often with NO COST to you

Each situation is different, but our goal is always to reach the best possible outcome for the sale of your property. We call ourselves "The Team Edge" because our team of Attorneys, Title agents, lenders, contractors and inspectors are all in place to ensure the process is fast and painless.

AVOIDING FORECLOSURE

The Government has implemented a number of programs to assist homeowners who are at risk of foreclosure and otherwise struggling with their monthly mortgage payments. The majority of these programs are administered through the U.S. Treasury Department and HUD. We have provided a summary of these various programs that we can help you with to save your home. Please continue reading in order to determine which program would be best for you.

Making Home Affordable

The Making Home Affordable © (MHA) Program is a critical part of the Governments broad strategy to help homeowners avoid foreclosure, stabilize the country's housing market, and improve the nation's economy.

We can help Homeowners lower their monthly mortgage payments and get into more stable loans at today's low rates. And for those homeowners for whom homeownership is no longer affordable or desirable, we can help you provide a way out which avoids foreclosure. Additionally, in an effort to be responsive to the needs of today's homeowners, we have many options for unemployed homeowners and homeowners who owe more than their homes are worth. Please read the following program summaries to determine which program options may be best suited for your particular circumstances.

Modify or Refinance Your Loan for Lower Payments

•Home Affordable Modification Program (HAMP): HAMP lowers your monthly mortgage payment to 31 percent of your verified monthly gross (pre-tax) income to make your payments more affordable. The typical HAMP modification results in a 40 percent drop in a monthly mortgage payment. Eighteen percent of HAMP homeowners reduce their payments by $1,000 or more. Contact us to find out how we can help you with this option.

•Principal Reduction Alternative (PRA): PRA was designed to help homeowners whose homes are worth significantly less than they owe by encouraging servicers and investors to reduce the amount you owe on your home. We can help you with this option.

•Second Lien Modification Program (2MP): If your first mortgage was permanently modified under HAMP SM and you have a second mortgage on the same property, you may be eligible for a modification or principal reduction on your second mortgage under 2MP. Likewise, If you have a home equity loan, HELOC, or some other second lien that is making it difficult for you to keep up with your mortgage payments, learn more about this MHA program. We can also help you with this option.

•Home Affordable Refinance Program (HARP): If you are current on your mortgage and have been unable to obtain a traditional refinance because the value of your home has declined, you may be eligible to refinance through HARP. HARP is designed to help you refinance into a new affordable, more stable mortgage. Once again, we can help you with this option.

“Underwater” Mortgages

In today's housing market, many homeowners have experienced a decrease in their home's value. We can help you learn about these MHA programs to address this concern for you, as a homeowner.

•Home Affordable Refinance Program (HARP): If you are current on your mortgage and have been unable to obtain a traditional refinance because the value of your home has declined, you may be eligible to refinance through HARP. HARP is designed to help you refinance into a new affordable, more stable mortgage. We can help you with this option.

•Principal Reduction Alternative: PRA was designed to help homeowners whose homes are worth significantly less than they owe by encouraging servicers and investors to reduce the amount you owe on your home. We can help you with this option.

•Treasury/FHA Second Lien Program (FHA2LP): If you have a second mortgage and the mortgage servicer of your first mortgage agrees to participate in FHA Short Refinance, you may qualify to have your second mortgage on the same home reduced or eliminated through FHA2LP. If the servicer of your second mortgage agrees to participate, the total amount of your mortgage debt after the refinance cannot exceed 115% of your home’s current value. We can help you with this option.

Assistance for Unemployed Homeowners

•Home Affordable Unemployment Program (UP): If you are having a tough time making your mortgage payments because you are unemployed, you may be eligible for UP. UP provides a temporary reduction or suspension of mortgage payments for at least twelve months while you seek re-employment. We can help you with this option.

•Emergency Homeowners’ Loan Program (EHLP): Our staff is here to help you with EHLP assistance provided in your state.

•FHA Special Forbearance: If you are having difficulty making mortgage payments because you are unemployed and have no other sources of income, you may be eligible for FHA's Special Forbearance. FHA now requires servicers to extend the forbearance period, by offering a reduced or suspended mortgage payment for up to twelve months, for FHA borrowers who qualify for the program. We can help you with this option as well.

Managed Exit for Borrowers

•Home Affordable Foreclosure Alternatives (HAFA): If your mortgage payment is unaffordable and you are interested in transitioning to more affordable housing, you may be eligible for a short sale or deed-in-lieu of foreclosure through HAFA SM. We can help you with this option.

•“Redemption”is a period after your home has already been sold at a foreclosure sale when you can still reclaim your home. You will need to pay the outstanding mortgage balance and all costs incurred during the foreclosure process.

Contact Us For Help!

If you are experiencing difficulties making your mortgage payments, you are encouraged to contact us for help directly to inquire about foreclosure prevention options that are available. If you are experiencing difficulty communicating with your mortgage lender or servicer about your need for mortgage relief, we can help you by contacting lenders and servicers on your behalf.

Assistance for FHA-Insured Homeowners

We work closely with The Federal Housing Administration (FHA), which is a part of the U.S. Department of Housing and Urban Development (HUD). We work aggressively to halt and reverse the losses represented by foreclosure. Through its National Servicing Center (NSC), the FHA offers a number of various loss mitigation programs and informational resources to assist FHA-insured homeowners and home equity conversion mortgage (HECM) borrowers facing financial hardship or unemployment and whose mortgage is either in default or at risk of default.

We help you by working with many of the programs listed here as well as with many other Real Estate strategies and solutions.

Contact US

Our staff are available to help answer your questions and assist you to better understand your options as an FHA borrower under many of these loss mitigation programs.

There are several ways you can contact US!

• Call Us at (727) 657.3339

•Email Us at:

jwdavis2013@gmail.com

Our Consultation is FREE! And there is no cost or obligation on your part for anything! Call us TODAY to schedule your appointment.

FORECLOSURE SCAMS

Dishonest companies or individuals sometimes target homeowners who are struggling to meet their mortgage commitment or are anxious to sell their homes. Scam operators like this promise to help you keep your home or sell your home without having to go into foreclosure, for a fee. However, they rarely deliver on what they promised.

These scam operators find potential victims in several ways:

•Advertise online and in local publications

•Contact people whose homes appear in the foreclosure notices (they can easily find these notices online or in a local newspaper)

•Target specific religious or ethnic groups

Common Foreclosure Scams

There are several types of foreclosure scams, but some scam activities or offers are common. Be cautious if the company:

•Advises that they can stop foreclosure by "helping" you file for bankruptcy

•Asks you to sign over the title to your house to them and make smaller rental payments to them until you can afford to buy the house back later

•Promises to act as an intermediary between you and your mortgage lender to refinance your loan

•Claims that they are affiliated with government mortgage modification programs (keep in mind that legitimate, government approved programs do not charge fees to participate in them)

•Encourages you to sign fake foreclosure rescue documents

•Claims that they can perform a forensic mortgage loan audit to help you hold onto your home.

FOR A SAFE AND SECURE CONSULTATION AND CONFIDENTIAL STRATEGEY AND SOLUTIONS MEETING TO SOLVE YOUR FORECLOSURE NEEDS, SCHEDULE YOUR APPOINTMENT TODAY. ITS FREE AND THERE IS NO OBLIGATION OR COMMITTMENT.

There are several ways you can contact US!

• Call Us at (727) 657.3339

•Email Us at:

jwdavis2013@gmail.com

Our Consultation is FREE! And there is no cost or obligation on your part for anything! Call us TODAY to schedule your appointment.

Ask me about Home Values, Buying, Selling,

Investment Properties, Relocating, Short Sales,

Foreclosures, Manufactured Housing, Refinancing,

Pre-Qualification, Property Management, Renting and

First Time Home Buyer Programs.

Call me today for more information.

I'd LOVE to see how I can be of service to you!

JW Davis

Real Estate Investor & PropertySpecialist

Office: 727.657.3339

Cell: 727.218.9584

727.657.3339

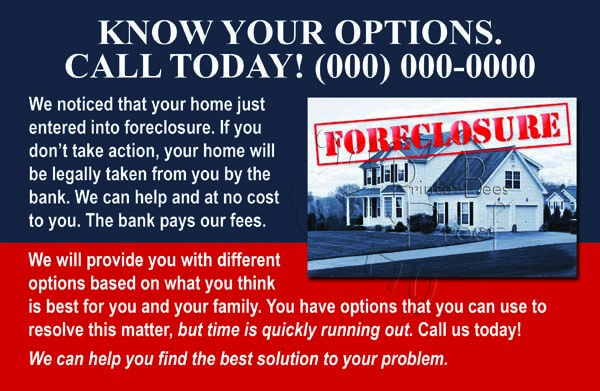

YOU HAVE OPTIONS

WE HAVE ANSWERS

1. Deed In Lieu of Foreclosure

2. Forbearance

3. Loan Modification

4. Short Sale

5. Foreclosure

We are negotiators and can help

you navigate rough waters

of a financial shipwreck. We will work with you and your lender to calculate your options so that

you can make an informed decision.

CONTACT US TODAY. WE CAN HELP!

727.657.3339

727.657.3339

727.657.3339

Falling behind on your mortgage payments can be scary! Knowing your options and taking action quickly is the key to resolving this situation and moving on gracefully past this difficult time!

We have helped many of our clients avoid foreclosure and we can help you as well!

HomesMostWanted.com is a DavisGroupCommunications.com Company